Country India Version

SAP- COUNTRY INDIA VERSION (CIN) is designed for use by business with operations in India. It comprises function designed specifically for India, a localization implementation guide (IMG), and a country template to help us customize the system according to local requirements.

Most of the country-specific functions for India relate to Financials and Logistics, and center around taxes, including:

Excise Duty:

Excise duty is a governmental levy on specific goods produced and consumed inside a country. In India, Central Excise Act, 1944 governs the excise matters like defining manufacturing, factory, excisable goods etc.

In India, excise duty is a tax on the manufacture of goods that is levied when goods leave the place of manufacture. Manufacturers can set off the duty paid on input materials against their output duty, a procedure known as central value-added tax (CENVAT).

Types of Excise Duty

Basic Excise Duty

This is the duty charged under section 3 of the Central Excises and Salt Act, 1944 on all excisable goods other than salt which are produced or manufactured in India at the rates set forth in the schedule to the Central Excise tariff Act, 1985.

Special Excise Duty

As per the Section 37 of the Finance Act, 1978 Special excise Duty was attracted on all excisable goods on which there is a levy of Basic excise Duty under the Central Excises and Salt Act, 1944.Since then each year the relevant provisions of the Finance Act specifies that the Special Excise Duty shall be or shall not be levied and collected during the relevant financial year.

Additional Excise Duty

Section 3 of the Additional duties of Excise (goods of special importance) Act, 1957 authorises the levy and collection in respect of the goods described in the Schedule to this Act. This is levied in lieu of sales Tax and shared between Central and State Governments. These are levied under different enactments like medicinal and toilet preparations, sugar etc. and other industries development etc.

SAP CIN IMG Path

To do any type of configuration according to our organization need the first step is to reach the implementation (IMG) guide screen. We can reach implementation guide in 2 ways:

1. Menu path

SAP IMG

IMG screen can be reached out just by following the below steps:

After SPRO, on the next screen click on "SAP Reference IMG".

Menu path for CIN Configuration

SAP- COUNTRY INDIA VERSION (CIN) is designed for use by business with operations in India. It comprises function designed specifically for India, a localization implementation guide (IMG), and a country template to help us customize the system according to local requirements.

Most of the country-specific functions for India relate to Financials and Logistics, and center around taxes, including:

- Excise duty and the central value-added tax system (CENVAT)

- Tax deducted at source (TDS)

- Sales tax

Excise Duty:

Excise duty is a governmental levy on specific goods produced and consumed inside a country. In India, Central Excise Act, 1944 governs the excise matters like defining manufacturing, factory, excisable goods etc.

In India, excise duty is a tax on the manufacture of goods that is levied when goods leave the place of manufacture. Manufacturers can set off the duty paid on input materials against their output duty, a procedure known as central value-added tax (CENVAT).

Types of Excise Duty

Basic Excise Duty

This is the duty charged under section 3 of the Central Excises and Salt Act, 1944 on all excisable goods other than salt which are produced or manufactured in India at the rates set forth in the schedule to the Central Excise tariff Act, 1985.

Special Excise Duty

As per the Section 37 of the Finance Act, 1978 Special excise Duty was attracted on all excisable goods on which there is a levy of Basic excise Duty under the Central Excises and Salt Act, 1944.Since then each year the relevant provisions of the Finance Act specifies that the Special Excise Duty shall be or shall not be levied and collected during the relevant financial year.

Additional Excise Duty

Section 3 of the Additional duties of Excise (goods of special importance) Act, 1957 authorises the levy and collection in respect of the goods described in the Schedule to this Act. This is levied in lieu of sales Tax and shared between Central and State Governments. These are levied under different enactments like medicinal and toilet preparations, sugar etc. and other industries development etc.

SAP CIN IMG Path

To do any type of configuration according to our organization need the first step is to reach the implementation (IMG) guide screen. We can reach implementation guide in 2 ways:

1. Menu path

We can navigate through the following path to reach out to IMG:

SAP Easy Access => Tools => Customizing => IMG => Execute Project

2.Transactional code

Best and simplest way to reach out any SAP screen is TCode i.e. transactional code. Transactional code to reach out IMG: SPRO (SAP Project Reference Object). Enter the Transaction code in command field and then click on enter.

2.Transactional code

Best and simplest way to reach out any SAP screen is TCode i.e. transactional code. Transactional code to reach out IMG: SPRO (SAP Project Reference Object). Enter the Transaction code in command field and then click on enter.

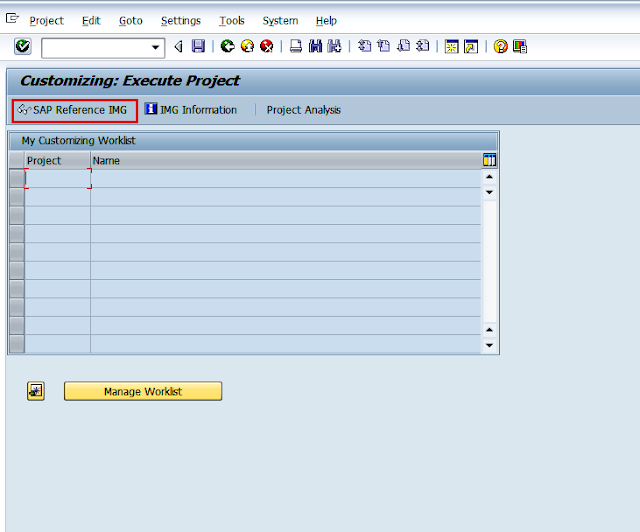

SAP IMG

IMG screen can be reached out just by following the below steps:

After SPRO, on the next screen click on "SAP Reference IMG".

IMG > LOGISTIC GENERAL > TAX ON GOODS MOVEMENT > INDIA

0 comments:

Post a Comment